Barely a day goes by in the media that there isn’t an article published discussing the challenges of the Australian housing market and how much prices have risen over recent years. The long held ‘Great Australian Dream’ of owning your own home is frequently trotted out to tug at the heart strings of TV viewers when trying to find a suitable scapegoat for sky high property prices. Throughout much of 2014, focus was being placed on foreign investors landing on our shores with suitcases full of money and pricing us locals out of the market. Currently the place for blame is on negative gearing. Whilst I’m happy to agree that negative gearing may have had some contribution to price rises, it’s important to take into account the huge amount for factors at play here. Although I’m no economist, it doesn’t take a genius to realise that the combination of negative gearing, foreign investment, historically low interest rates, ease of finance, ongoing agent under-quoting and the sense of urgency portrayed in the media all play a role. Not to mention the fact that almost 70% of Australians choose to live in capital cities and that there is only so much land available in these relatively tiny pockets of our enormous country. Geography and demographics certainly play a role.

Barely a day goes by in the media that there isn’t an article published discussing the challenges of the Australian housing market and how much prices have risen over recent years. The long held ‘Great Australian Dream’ of owning your own home is frequently trotted out to tug at the heart strings of TV viewers when trying to find a suitable scapegoat for sky high property prices. Throughout much of 2014, focus was being placed on foreign investors landing on our shores with suitcases full of money and pricing us locals out of the market. Currently the place for blame is on negative gearing. Whilst I’m happy to agree that negative gearing may have had some contribution to price rises, it’s important to take into account the huge amount for factors at play here. Although I’m no economist, it doesn’t take a genius to realise that the combination of negative gearing, foreign investment, historically low interest rates, ease of finance, ongoing agent under-quoting and the sense of urgency portrayed in the media all play a role. Not to mention the fact that almost 70% of Australians choose to live in capital cities and that there is only so much land available in these relatively tiny pockets of our enormous country. Geography and demographics certainly play a role.

Of course I’m biased…but while I do think that negative gearing has an important role to play in supporting investors and in turn the housing market in Australia, I agree with statements made regarding investors only investing in property simply for the tax advantages. To me, purely investing for the benefits of negative gearing is completely the wrong approach (although plenty do it). Following here are two videos worth a watch. The first is a clip from ‘The Project’ on Network 10 which aired last night and fired me up to write about this topic. Pay careful attention to the generalised statements and overall tone of the clip, it’s enough to make you go out and push the nearest property investor under a bus. The second clip by well known Australian property investing wunderkind Nathan Birch is intriguingly entitled Negative Gearing Sucks Balls. Nathan’s explanation about negative gearing and why people get caught out by it is spot on in my view. My thoughts? Negative gearing is a useful bonus for investors but certainly not a reason in itself to invest in property. Check out the clips below and make up your own mind!

So it’s federal budget night in Australia and there have been rumblings for some time now that the government might be looking to reform their negative gearing policy for property investors. The most frequent suggestion that I have heard is regarding the possibility of introducing grandfathering arrangements for current property investors whilst restricting any future negative gearing to newly constructed properties. Whilst this has the potential to save the government billions of dollars, there is still plenty of debate as to the flow-on effects that it might have. Whilst on one hand there are those stating that negative gearing has done nothing but escalate property prices for those wanting to purchase their own home (Check out the

So it’s federal budget night in Australia and there have been rumblings for some time now that the government might be looking to reform their negative gearing policy for property investors. The most frequent suggestion that I have heard is regarding the possibility of introducing grandfathering arrangements for current property investors whilst restricting any future negative gearing to newly constructed properties. Whilst this has the potential to save the government billions of dollars, there is still plenty of debate as to the flow-on effects that it might have. Whilst on one hand there are those stating that negative gearing has done nothing but escalate property prices for those wanting to purchase their own home (Check out the

When it comes to investing in property everyone seems to be an expert and is full of advice, both good and bad. You’ll hear disaster stories by the bucket load and I often suggest that a lot of this information comes from people who have not experienced property investing themselves. You’ll hear “I have a friend that had a terrible experience when…” etc, etc. So going on this philosophy you’d be inclined to think that advice from someone who has done it before would be a lot more useful. Often it is, but you still need to approach it with a critical eye and always ask yourself when receiving advice from someone, what’s in it for them? This, I’d also strongly recommend when attending one of the many property investment workshops or seminars that are frequently marketed to the masses. There are lots to choose from and whilst some are very informative and useful, there are also ones out there that are simply a sales pitch.

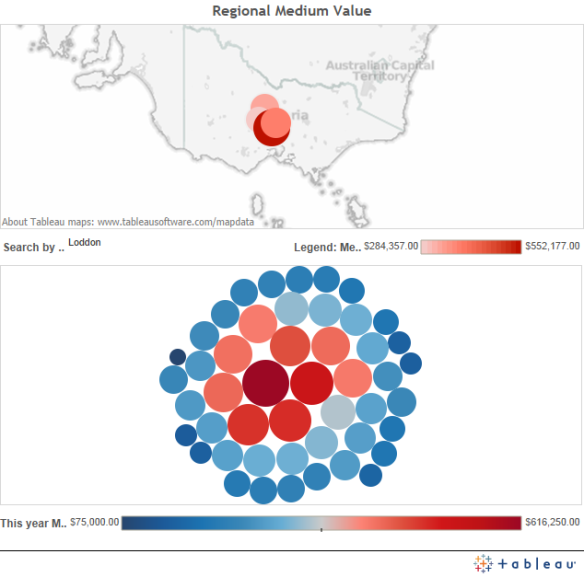

When it comes to investing in property everyone seems to be an expert and is full of advice, both good and bad. You’ll hear disaster stories by the bucket load and I often suggest that a lot of this information comes from people who have not experienced property investing themselves. You’ll hear “I have a friend that had a terrible experience when…” etc, etc. So going on this philosophy you’d be inclined to think that advice from someone who has done it before would be a lot more useful. Often it is, but you still need to approach it with a critical eye and always ask yourself when receiving advice from someone, what’s in it for them? This, I’d also strongly recommend when attending one of the many property investment workshops or seminars that are frequently marketed to the masses. There are lots to choose from and whilst some are very informative and useful, there are also ones out there that are simply a sales pitch. As you may have picked up I’m passionate about regional investment and it forms a large part of my portfolio. A lot of people are skeptical about regional investment and subsequently limit themselves to capital cities. Whilst capital cities have often shown better capital growth than some regional areas there are also some great reasons to consider investing outside of metropolitan areas, not the least of which is that it’s commonly a lot less expensive to get into the market. I have heard many people comment about how expensive it is to purchase in capital cities and that sometimes it’s next to impossible, however in the same breath you’ll hear them comment that regional cities don’t return the same capital growth, so what do they do? Nothing!

As you may have picked up I’m passionate about regional investment and it forms a large part of my portfolio. A lot of people are skeptical about regional investment and subsequently limit themselves to capital cities. Whilst capital cities have often shown better capital growth than some regional areas there are also some great reasons to consider investing outside of metropolitan areas, not the least of which is that it’s commonly a lot less expensive to get into the market. I have heard many people comment about how expensive it is to purchase in capital cities and that sometimes it’s next to impossible, however in the same breath you’ll hear them comment that regional cities don’t return the same capital growth, so what do they do? Nothing!