So in September of 2013 I published a post talking about the difference between Company Title and Strata Title. The example that I used to illustrate this was a one bedroom apartment located in Potts Point in Sydney. This time capsule of a property had been boarded up for over 20 years and was in largely original condition. Whilst that post was talking about the restrictions that may be in place with Company Title, today’s post is quite different. The apartment itself was snapped up quickly (for a value of around $435,000) and someone’s been pretty busy over the last 8 months!

So in September of 2013 I published a post talking about the difference between Company Title and Strata Title. The example that I used to illustrate this was a one bedroom apartment located in Potts Point in Sydney. This time capsule of a property had been boarded up for over 20 years and was in largely original condition. Whilst that post was talking about the restrictions that may be in place with Company Title, today’s post is quite different. The apartment itself was snapped up quickly (for a value of around $435,000) and someone’s been pretty busy over the last 8 months!

By the looks of the sales pictures the unit was taken back to its bare bones and given a new lease on life. With only 53 sq m to work with it’s a pretty small canvas but what a result! Who would have thought that in less than a year the same place would be showcased with descriptions such as beautiful polished hardwood floors, a streamlined Caesar Stone kitchen with integrated stainless steel appliances and a stylish designer over-sized bathroom (over-sized for 53 sq m I’m guessing). They even managed to squeeze in a concealed laundry.

As with the first sale it came on to the market and was under offer in no time, this time at $610,000! Click here to see the agent’s listing. Although I’m not a professional renovator I think we can safely guess that the renovation itself would not have cost $175,000 so there is a tidy profit in store for this savvy flipper. The catch with this property though is that it still falls under company title so landlords looking for a good investment would have no luck as leasing is not permitted in the building. I’m guessing that it will make a nice pied-à-terre for an executive on the move! Check out some of the before and after images below.

You wouldn’t be wrong if you said that property investment and the subsequent property management that goes along with it can be a competitive business. It can take a good amount of research and experience to decide on what your criteria is that makes the ideal property manager for your requirements. Whilst my property manager

You wouldn’t be wrong if you said that property investment and the subsequent property management that goes along with it can be a competitive business. It can take a good amount of research and experience to decide on what your criteria is that makes the ideal property manager for your requirements. Whilst my property manager

So it’s federal budget night in Australia and there have been rumblings for some time now that the government might be looking to reform their negative gearing policy for property investors. The most frequent suggestion that I have heard is regarding the possibility of introducing grandfathering arrangements for current property investors whilst restricting any future negative gearing to newly constructed properties. Whilst this has the potential to save the government billions of dollars, there is still plenty of debate as to the flow-on effects that it might have. Whilst on one hand there are those stating that negative gearing has done nothing but escalate property prices for those wanting to purchase their own home (Check out the

So it’s federal budget night in Australia and there have been rumblings for some time now that the government might be looking to reform their negative gearing policy for property investors. The most frequent suggestion that I have heard is regarding the possibility of introducing grandfathering arrangements for current property investors whilst restricting any future negative gearing to newly constructed properties. Whilst this has the potential to save the government billions of dollars, there is still plenty of debate as to the flow-on effects that it might have. Whilst on one hand there are those stating that negative gearing has done nothing but escalate property prices for those wanting to purchase their own home (Check out the

The article below appeared today in the news.com.au real estate section and is a timely reminder of the financial drain that some people can find themselves in over the Christmas period. When it comes to weighing up between the many costs of surviving Christmas or paying rent on time the landlord can often be the loser ending up with a nasty new year surprise! The key lesson mentioned in the article and one that I fully support is to ensure that you utilise the services of a professional property manager, they are are worth every cent when something goes wrong and they know exactly what to do about it, after all, that’s their specialty. Read on below or

The article below appeared today in the news.com.au real estate section and is a timely reminder of the financial drain that some people can find themselves in over the Christmas period. When it comes to weighing up between the many costs of surviving Christmas or paying rent on time the landlord can often be the loser ending up with a nasty new year surprise! The key lesson mentioned in the article and one that I fully support is to ensure that you utilise the services of a professional property manager, they are are worth every cent when something goes wrong and they know exactly what to do about it, after all, that’s their specialty. Read on below or

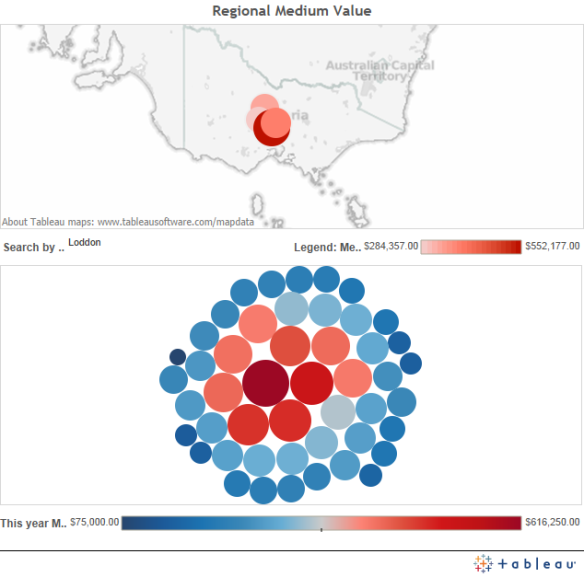

As you may have picked up I’m passionate about regional investment and it forms a large part of my portfolio. A lot of people are skeptical about regional investment and subsequently limit themselves to capital cities. Whilst capital cities have often shown better capital growth than some regional areas there are also some great reasons to consider investing outside of metropolitan areas, not the least of which is that it’s commonly a lot less expensive to get into the market. I have heard many people comment about how expensive it is to purchase in capital cities and that sometimes it’s next to impossible, however in the same breath you’ll hear them comment that regional cities don’t return the same capital growth, so what do they do? Nothing!

As you may have picked up I’m passionate about regional investment and it forms a large part of my portfolio. A lot of people are skeptical about regional investment and subsequently limit themselves to capital cities. Whilst capital cities have often shown better capital growth than some regional areas there are also some great reasons to consider investing outside of metropolitan areas, not the least of which is that it’s commonly a lot less expensive to get into the market. I have heard many people comment about how expensive it is to purchase in capital cities and that sometimes it’s next to impossible, however in the same breath you’ll hear them comment that regional cities don’t return the same capital growth, so what do they do? Nothing!