I was reading recently that less than 8% of the Australian population are property investors which equates to about 1.8 million people. Of these, the Australian Tax Office reported that 72% of these investors (or around 1.3 million) own just one property. There is a steep drop to less than 100,000 people that own more than 3 properties and less than 1% of Australian property investors (about 15,000 people in the entire country) own more than 6 properties. This information not only shows how few people manage to develop a large property portfolio but also that there is a huge proportion of people that never even get their foot on the ladder. Of course property investing is not everyone’s cup of tea but I have spoken with many people just wanting to make a start but possibly not feeling prepared to take the leap of faith. Today I was speaking with a family member who was interested in learning more about the steps to take to get on the investment ladder. I mapped out a basic example of what I would consider a great ‘starter’, something quite similar to what I started with on my first investment and also an investment which won’t break the bank to get you started. Let’s take a look.

The property I chose to demonstrate with was a one bedroom unit currently for sale in a regional city of around 100,000 people. It is serviced well with good infrastructure and is close to necessary facilities (shops, hospitals, schools etc). The location is highly desirable and the unit itself appears to be in excellent condition. It is for sale for $145k – $155k. Let’s say that we manage to get an offer of $145k accepted, what do the figures look like and is it affordable?

The property I chose to demonstrate with was a one bedroom unit currently for sale in a regional city of around 100,000 people. It is serviced well with good infrastructure and is close to necessary facilities (shops, hospitals, schools etc). The location is highly desirable and the unit itself appears to be in excellent condition. It is for sale for $145k – $155k. Let’s say that we manage to get an offer of $145k accepted, what do the figures look like and is it affordable?

|

|

|

| How Much Will It Cost Me? |

|

|

| Property Price – $145,000 |

Deposit (10%) – $14500 |

Mortgage – $130500 |

|

Stamp Duty – $3700 |

Interest Rate – 5.5% |

|

Conveyancing – $800 |

|

|

Mortgage Insurance – $1800 |

|

| Total Costs (estimated) |

$20800 |

|

These are the main costs with a deposit of 10%, if you can get to 20% for a deposit the mortgage insurance disappears and the total estimated cost would then be $33,500. So you could get the property for an initial outlay of between $20,800 and $33,500 but what then? How are you going to service the loan and how much is it going to cost out of your own pocket?

|

|

|

| How Much Will It Cost To Service? |

|

|

| Loan Amount – $130,500 |

Council Rates – $900 |

Rent Income – $200/wk |

| Interest Rate – 5.5% |

Water Rates – $900 |

|

| Weekly Repayments – $171 |

Body Corp – $800 |

|

| |

Property Mgmt. – $728 |

|

| Yearly Repayments – $8892 |

Yearly Costs – $3328 |

Rent/Yr – $10400 |

The rent on this property is very healthy and over the course of the year you would be out of pocket $1820 (or $35 a week). Remember that this is a ‘one moment in time’ scenario and things can change in both positive and negative ways. The interest rate above is fairly conservative currently, I could locate a deal at 4.69% which would reduce your weekly repayments to $156 meaning you’re now only out of pocket $20 a week! If you managed the initial 20% deposit at that interest rate then your repayments drop to $139/week which means you would have to dig between the couch cushions once a week to find the spare $3 to fund your investment property!

On the flip side you also need to be aware that tenants can move out, things can break that need repairing and the cost of rates, insurance and property management can (and usually do) go up. It would be great to only have to pay $3 a week but in reality it will sometimes be more than that. Can I afford $20, $50 or even $100 a week if it came to that? These are all questions that you need to ask yourself and factor into your own budget. Overall though, what I’m hoping is that this example shows that you don’t need to be a millionaire to start on the investment ladder. Yes it takes some saving but it’s property and you don’t get it for free. When you do the sums though it can often work out to be a lot less than you may have initially thought!

In early August I published a post about our former Prime Minister Julia Gillard snapping up some new multi-million dollar digs in South Australia. Not surprisingly a few months later we hear that the PM’s former house in suburban Altona is now on the market. Our first female PM purchased her modest Altona home for $140,000 and now it’s expected to sell in excess of $600,000. Not surprisingly the internet listing has had a huge amount of hits with thousands logging on to have a look. The first open for inspections are occurring this weekend with the Auction scheduled for Saturday December 14th. So dust off your empty fruit bowl and get the cheque book ready, Julia and Tim’s love nest could be yours if the price is right!

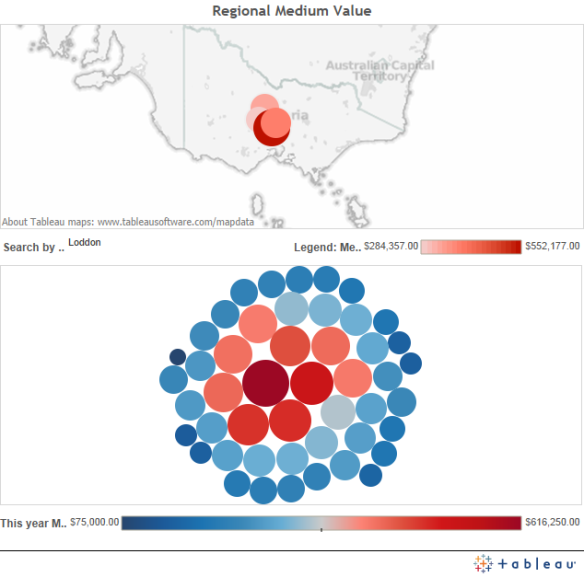

In early August I published a post about our former Prime Minister Julia Gillard snapping up some new multi-million dollar digs in South Australia. Not surprisingly a few months later we hear that the PM’s former house in suburban Altona is now on the market. Our first female PM purchased her modest Altona home for $140,000 and now it’s expected to sell in excess of $600,000. Not surprisingly the internet listing has had a huge amount of hits with thousands logging on to have a look. The first open for inspections are occurring this weekend with the Auction scheduled for Saturday December 14th. So dust off your empty fruit bowl and get the cheque book ready, Julia and Tim’s love nest could be yours if the price is right! As you may have picked up I’m passionate about regional investment and it forms a large part of my portfolio. A lot of people are skeptical about regional investment and subsequently limit themselves to capital cities. Whilst capital cities have often shown better capital growth than some regional areas there are also some great reasons to consider investing outside of metropolitan areas, not the least of which is that it’s commonly a lot less expensive to get into the market. I have heard many people comment about how expensive it is to purchase in capital cities and that sometimes it’s next to impossible, however in the same breath you’ll hear them comment that regional cities don’t return the same capital growth, so what do they do? Nothing!

As you may have picked up I’m passionate about regional investment and it forms a large part of my portfolio. A lot of people are skeptical about regional investment and subsequently limit themselves to capital cities. Whilst capital cities have often shown better capital growth than some regional areas there are also some great reasons to consider investing outside of metropolitan areas, not the least of which is that it’s commonly a lot less expensive to get into the market. I have heard many people comment about how expensive it is to purchase in capital cities and that sometimes it’s next to impossible, however in the same breath you’ll hear them comment that regional cities don’t return the same capital growth, so what do they do? Nothing!