A few weeks ago I posted about Julia Gillard’s house being on the market for sale. Well yesterday was auction day and I think our former Prime Minister would be pretty pleased. Considering the median house price for Altona is $560,000 the sale made it all the way to $921,000! Not a bad little earner considering that she purchased the place in 1998 for $140,000!

Festive Finances!

The article below appeared today in the news.com.au real estate section and is a timely reminder of the financial drain that some people can find themselves in over the Christmas period. When it comes to weighing up between the many costs of surviving Christmas or paying rent on time the landlord can often be the loser ending up with a nasty new year surprise! The key lesson mentioned in the article and one that I fully support is to ensure that you utilise the services of a professional property manager, they are are worth every cent when something goes wrong and they know exactly what to do about it, after all, that’s their specialty. Read on below or click here to go to the original article –

The article below appeared today in the news.com.au real estate section and is a timely reminder of the financial drain that some people can find themselves in over the Christmas period. When it comes to weighing up between the many costs of surviving Christmas or paying rent on time the landlord can often be the loser ending up with a nasty new year surprise! The key lesson mentioned in the article and one that I fully support is to ensure that you utilise the services of a professional property manager, they are are worth every cent when something goes wrong and they know exactly what to do about it, after all, that’s their specialty. Read on below or click here to go to the original article –

THE festive season is a danger period for property investors, and real estate experts are warning landlords to make sure they don’t suffer a financial hit from tardy tenants.

The general manager of Harris Property Management, Suzie Hamilton-Flanagan, says rental arrears can jump by more than 20 per cent over Christmas as tenants find other areas to spend money. ‘Sometimes rent is the last thing on their list,” she says. ‘Landlords managing their own properties need to make sure they are on top of this from the start, or they risk paying for their tenant’s good cheer.” Some landlord insurance policies provide cover for tenants who fail to pay, but Hamilton-Flanagan says if a landlord fails to go through the correct processes when dealing with late-paying tenants, ‘an insurance payout for a late rental claim can be impacted”. She says one suggestion during December may be to send the tenants a card, perhaps with a small gift, gently reminding them of payment dates during the busy Christmas season. ‘Create a relationship with the tenant and treat people as you would want to be treated. The mentality of a tenant is they are paying you this money and they want bang for their buck – they want the property maintained, repaired and the landlord to be respectful.” The first step in preventing late payment is to select the right tenant from the start, Hamilton-Flanagan says, which involves checking a tenant’s payment history by contacting previous agents and landlords.

Carolyn Majda, executive manager at landlord insurer Terri Scheer Insurance, says one of the best ways to protect yourself is to use a professional property manager. ‘That way you have someone who is looking after the rent religiously,” she says. Majda says a lot of property managers send out pre-Christmas newsletters with rental payment dates included. ‘It’s nice to send a Christmas card – we all lose track of dates around this time of the year.” She says investors who manage a property themselves need to be on top of any late payments immediately. ‘Don’t let it start accruing. The longer time goes, the bigger the problem for both landlord and tenant,” Majda says.’Even if it is a day late, be on top of it.’It’s also really important that you take out insurance at the start of a tenancy, before you have people in there, because if they are behind in their rent it can create some issues – it’s almost like having a car accident and then insuring your car.”

The original version of this article appears here

The Top Mistakes made by new Property Investors

Some wise words on things to consider when taking the first step on the property investment ladder!

So what do you think the top mistakes are that the newbie property investor makes? Buying the wrong property? Choosing bad tenants? Well lets see:

1 – Not pulling the trigger

You keep finding excuses not to buy. The market isn’t right, you don’t have time to devote to searching for the right property, you are worried about making mistakes. Well, there is never a good time, and you will make the odd mistake or two. So don’t panic and just go for it.

2 – You get what you pay for

Buy cheap, get cheap. So you need to go for a well maintained solid property. You don’t have to buy the top of the line properties, but you have to buy a property that isn’t going to kill you on the maintenance costs either.

3 – It’s not all about rent

A positively geared property is a great…

View original post 323 more words

Horrifié! A landlord’s worst nightmare

In the news this week we’ve seen a report about a French tenant who decided to let loose in his landlord’s apartment after his landlord refused to return his $2,500 deposit. Not only did he do some major damage wielding a sledgehammer but cleverly (read: not clever at all) recorded himself doing the damage and then posted it on YouTube. The video is titled “vengeance d’un locataire” (revenge of a tenant) and shows him doing his finest work to the bathroom toilet, mirror and shower before moving into the living area to do a bit more impromptu demolition. Whilst we don’t know the background story to this situation, the response by the tenant might be seen by some to be a touch extreme. I think we can also safely guess that not only will he now not be getting his deposit back, but with video evidence plastered all over the internet this outburst is likely to end up costing him a whole lot more than $2,500.

In the news this week we’ve seen a report about a French tenant who decided to let loose in his landlord’s apartment after his landlord refused to return his $2,500 deposit. Not only did he do some major damage wielding a sledgehammer but cleverly (read: not clever at all) recorded himself doing the damage and then posted it on YouTube. The video is titled “vengeance d’un locataire” (revenge of a tenant) and shows him doing his finest work to the bathroom toilet, mirror and shower before moving into the living area to do a bit more impromptu demolition. Whilst we don’t know the background story to this situation, the response by the tenant might be seen by some to be a touch extreme. I think we can also safely guess that not only will he now not be getting his deposit back, but with video evidence plastered all over the internet this outburst is likely to end up costing him a whole lot more than $2,500.

Some lessons to learn from this example –

- Get a professional property manager to take care of all things to do with rent and bond payment.

- Make sure you always have current landlord’s insurance with a good amount of cover.

- Don’t leave sledgehammers around near a disgruntled tenant.

Why You Shouldn’t Listen to Donald Trump – The Barefoot Investor

When it comes to investing in property everyone seems to be an expert and is full of advice, both good and bad. You’ll hear disaster stories by the bucket load and I often suggest that a lot of this information comes from people who have not experienced property investing themselves. You’ll hear “I have a friend that had a terrible experience when…” etc, etc. So going on this philosophy you’d be inclined to think that advice from someone who has done it before would be a lot more useful. Often it is, but you still need to approach it with a critical eye and always ask yourself when receiving advice from someone, what’s in it for them? This, I’d also strongly recommend when attending one of the many property investment workshops or seminars that are frequently marketed to the masses. There are lots to choose from and whilst some are very informative and useful, there are also ones out there that are simply a sales pitch.

When it comes to investing in property everyone seems to be an expert and is full of advice, both good and bad. You’ll hear disaster stories by the bucket load and I often suggest that a lot of this information comes from people who have not experienced property investing themselves. You’ll hear “I have a friend that had a terrible experience when…” etc, etc. So going on this philosophy you’d be inclined to think that advice from someone who has done it before would be a lot more useful. Often it is, but you still need to approach it with a critical eye and always ask yourself when receiving advice from someone, what’s in it for them? This, I’d also strongly recommend when attending one of the many property investment workshops or seminars that are frequently marketed to the masses. There are lots to choose from and whilst some are very informative and useful, there are also ones out there that are simply a sales pitch.

When browsing through the blog from Scott Pape at The Barefoot Investor I came across the article below highlighting that even when the advice is coming from one of the most successful real estate tycoons of all time you can still be taken for a ride. Click below and read on…

Why You Shouldn’t Listen to Donald Trump – The Barefoot Investor

Invest in some political history.

In early August I published a post about our former Prime Minister Julia Gillard snapping up some new multi-million dollar digs in South Australia. Not surprisingly a few months later we hear that the PM’s former house in suburban Altona is now on the market. Our first female PM purchased her modest Altona home for $140,000 and now it’s expected to sell in excess of $600,000. Not surprisingly the internet listing has had a huge amount of hits with thousands logging on to have a look. The first open for inspections are occurring this weekend with the Auction scheduled for Saturday December 14th. So dust off your empty fruit bowl and get the cheque book ready, Julia and Tim’s love nest could be yours if the price is right!

In early August I published a post about our former Prime Minister Julia Gillard snapping up some new multi-million dollar digs in South Australia. Not surprisingly a few months later we hear that the PM’s former house in suburban Altona is now on the market. Our first female PM purchased her modest Altona home for $140,000 and now it’s expected to sell in excess of $600,000. Not surprisingly the internet listing has had a huge amount of hits with thousands logging on to have a look. The first open for inspections are occurring this weekend with the Auction scheduled for Saturday December 14th. So dust off your empty fruit bowl and get the cheque book ready, Julia and Tim’s love nest could be yours if the price is right!

You can also view the DOMAIN Video by clicking here.

It’s real estate reality!

I’m a sucker for some reality TV and when it’s combined with real estate I’m in heaven. I’ve been addicted for a good while to Million Dollar Listing which is an American reality series filmed in a similar way to the Real Housewives series (they may not admit it but I know several readers that are regular viewers), There are series set in both LA and New York and each feature a range of over the top and outrageous properties being sold by even more over the top and outrageous real estate agents. Below are a couple of clips from previous seasons. If you love big properties and big personalities then I’d recommend getting into what some would describe as real estate porn!

A slam dunk for around $29 million

It’s been a while since I’ve come across a stunner of a celebrity property but I’m thinking that if this one doesn’t fit the bill then I’ll never find one that will. Offered up for sale in February last year at a measly $29,000,000, Michael Jordan’s custom designed home of 20 years failed to find a buyer. Now it’s up for auction this time and if you can cough up the $250,000 just to register as a bidder then you could be in the running!

The home itself is a massive 56,000 square feet and is located on 7.39 acres of land about half an hour outside of Chicago. Whilst there is no shortage of space to sleep with 9 bedrooms available, you could go for almost 3 weeks without having to use the same bathroom twice (there are 19!) and 2 weeks without having to park your luxury car in the same spot (there are 15 heated car spaces!). Check out the agent’s video below to see more of this amazing home and not surprisingly it comes with it’s own basketball court.

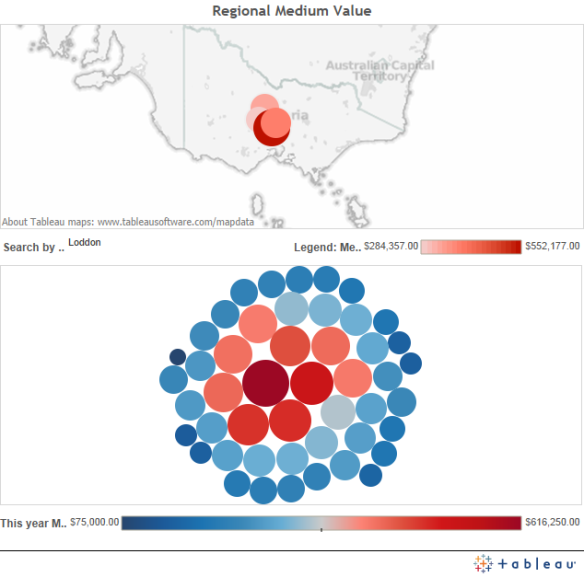

Regional Property Prices

As you may have picked up I’m passionate about regional investment and it forms a large part of my portfolio. A lot of people are skeptical about regional investment and subsequently limit themselves to capital cities. Whilst capital cities have often shown better capital growth than some regional areas there are also some great reasons to consider investing outside of metropolitan areas, not the least of which is that it’s commonly a lot less expensive to get into the market. I have heard many people comment about how expensive it is to purchase in capital cities and that sometimes it’s next to impossible, however in the same breath you’ll hear them comment that regional cities don’t return the same capital growth, so what do they do? Nothing!

As you may have picked up I’m passionate about regional investment and it forms a large part of my portfolio. A lot of people are skeptical about regional investment and subsequently limit themselves to capital cities. Whilst capital cities have often shown better capital growth than some regional areas there are also some great reasons to consider investing outside of metropolitan areas, not the least of which is that it’s commonly a lot less expensive to get into the market. I have heard many people comment about how expensive it is to purchase in capital cities and that sometimes it’s next to impossible, however in the same breath you’ll hear them comment that regional cities don’t return the same capital growth, so what do they do? Nothing!

It’s important to do your homework and weigh up the pros and cons before you limit yourself to just one market which can potentially mean you end up doing nothing and waiting for the prices to drop (it might never happen!). Today I came across the data below which provides the median (not medium as written!) value of a large range of Victorian towns and cities. Information like this can be difficult to come across so it’s good when you can find it. Click on the image below to be taken to the active site. There you can also select and search by region.

Doing the sums #2

I had some great responses to my post on October 13th about doing the sums when looking at investment properties and how important (and sometimes surprising) it is to get an idea of how much it will cost you to start and also to maintain. I’m always keeping an eye out for great examples so will post them when I come across something which shows a simple and affordable approach.

This property is a simple one bedroom unit in a complex of 12 units. It’s in a well established suburban area which is well regarded and in the same city as my first example. The area again demonstrates good infrastructure and is close to necessary facilities (shops, hospitals, schools etc).

On face value the unit appears to be well maintained but of course you would want to inspect not only the property itself but also look around the complex and the units around it. It is for sale for $142,500 and is returning a healthy $190/week. Let’s say that it ticks the boxes as far as the quality and standard of the complex and we manage to get a realistic offer of $140k accepted. What do the figures look like and is it affordable?

| How Much Will It Cost Me? | ||

| Property Price – $140,000 | Deposit (10%) – $14000 | Mortgage – $126,000 |

| Stamp Duty – $3470 | Interest Rate – 4.69% | |

| Conveyancing – $800 | ||

| Mortgage Insurance – $1800 | ||

| Total Costs (estimated) | $20070 |

Once again, these are the main costs with a deposit of 10%, if you can get to 20% for a deposit the mortgage insurance disappears and the total estimated cost would then be $32,270. So you could get this property for an initial outlay of between $20,070 and $32,270. This is all great but let’s once again look at how you maintain this. Rather than being overly conservative, this time I’ve gone with one of the better interest rates that I can find at the moment of 4.69%

| How Much Will It Cost To Service? | ||

| Loan Amount – $126,000/$112,000 |

Council Rates – $900 | Rent Income – $190/wk |

| Interest Rate – 4.69% | Water Rates – $900 | |

| Repayments/Wk (10% deposit) – $150.50 |

Body Corp – $800 | |

| Repayments/Wk (20% deposit) – $134.00 |

Property Mgmt. – $700 | |

| Yearly Repayments – $7826/6968 | Yearly Costs – $3300 | Rent/Yr – $9880 |

For a 1 bedroom unit the rent is very good and in a tight rental market this is becoming increasingly realistic. If you started with the 10% deposit you would find yourself out of pocket $1246 a year (or $24 a week). If you managed to pull together the 20% deposit you would be out of pocket $388 a year or less than $7.50 a week! A dollar a day really is loose change! Come tax time and factoring in some depreciation I’d think it could even be likely to end up being cost neutral.

Again remember this is a ‘one moment in time’ scenario and things can change, but even with some unforeseen expenses and the odd maintenance request a property like this has the potential to be a great starter for an investment portfolio!