Thanks to everyone who is sending me ideas and great pieces for the blog. My wonderful sister who also loves a bit of property investment herself sent me this great advertisement for a property currently for sale in South Australia. I’ve heard people comment about getting their money’s worth out of their estate agent and the vendors of this house have done particularly well with theirs. I can’t envisage a lot of agents out their singing and dancing (even if pretty badly) to sell a property but good luck to him, it’s certainly unique!

Australia

Renovating Housing Policy

The Grattan Institute was formed in 2008 as an ‘independent think tank’ intended to develop public policy for Australia. This week there has been a lot of media commentary about a publication by the institute addressing housing policy in Australia. Renovating Housing Policy was published on October 20th and states:

The Grattan Institute was formed in 2008 as an ‘independent think tank’ intended to develop public policy for Australia. This week there has been a lot of media commentary about a publication by the institute addressing housing policy in Australia. Renovating Housing Policy was published on October 20th and states:

This report looks at our complex housing system as a whole. By quantifying the major government outlays on the private housing system, it reveals the cumulative impact of housing policies both on individual choices of where and how to live, and on productivity and inequality in our cities.

The initial part of the report examines some fascinating trends and demographics related to home ownership in Australia, there is interesting data presented on the change in home ownership rates over the last 100 years as well as examination of current ownership rates by age as well as earnings. It then continues on to look at renting in Australia and it is from here that the information presented starts to become increasingly relevant to property investors. There is also significant focus within the report looking at the different government support provided to property owners versus those who rent a home. The report states that support for residential property investors costs $6.8 billion a year,or about $4,500 per year for each investor household. If you want to skip to the really interesting part though I’d suggest heading straight to page 36 where the recommendations commence. There are three main recommendations looking at stamp duty and property tax, reform of tax incentives for property investment and also reform of the private rental sector.

Whilst I certainly don’t agree with all of the proposals there appears to be some strong evidence available to support the statements being put forward. What I have found interesting is the way that it has been portrayed in a range of media and particularly the comments that have been posted by readers. I’d be eager to hear people’s thoughts on this as it would have a significant impact on property investors should these recommendations be put into practice. Don’t be afraid to comment below! Click here to read the article.

You can also check out some of the following media articles, don’t forget to check the reader’s comments, it’s certainly stirred up some debate!

MoneySmartAu

Thanks to my good friend and avid reader of my blog Renee for reminding us of the great website www.moneysmart.gov.au and also their Facebook page. The website is full of great (and sensible) suggestions and ideas looking at money management, borrowing, credit and importantly property investing just to name a few. It’s an Australian site but a lot of the information could be utilised wherever you may be living. The Facebook page poses regular questions to readers about their own thoughts on money management and contains some excellent (and provocative) discussions. Posted yesterday was the question ‘Do you think it’s easier to rent or buy a home?‘ Check it out and see what people are thinking. Is there a right or wrong answer to this question? The range of discussion suggests maybe not! There is also a MoneySmartAu YouTube channel that has a range of videos on some really useful money management ideas.

Thanks to my good friend and avid reader of my blog Renee for reminding us of the great website www.moneysmart.gov.au and also their Facebook page. The website is full of great (and sensible) suggestions and ideas looking at money management, borrowing, credit and importantly property investing just to name a few. It’s an Australian site but a lot of the information could be utilised wherever you may be living. The Facebook page poses regular questions to readers about their own thoughts on money management and contains some excellent (and provocative) discussions. Posted yesterday was the question ‘Do you think it’s easier to rent or buy a home?‘ Check it out and see what people are thinking. Is there a right or wrong answer to this question? The range of discussion suggests maybe not! There is also a MoneySmartAu YouTube channel that has a range of videos on some really useful money management ideas.

A house fit for an (ex) Prime Minister

Without wanting to declare my political leanings I’ve always been a fan of Australia’s first female Prime Minister Julia Gillard. So after recent events with Kevin Rudd taking back the top job, what is a former PM to do as far as getting some distinguished digs? Well considering that Julia purchased her former home in Altona for a modest  $140,000 in 1998 but has been used to living in The Lodge and Kirribilli for the last few years I’m guessing that her standards have gone up (nothing against Altona…well not much). Word on the street is that Julia and the former ‘first bloke’ Tim Mathieson have snapped up a new abode in her former home town of Adelaide. A sold sticker was placed on the for sale board out the front of the Adelaide property earlier this week and it is believed that the property has been purchased through a buyer’s agent for a price around the 2 million dollar mark. Interestingly the listing by the agent has now been removed.

$140,000 in 1998 but has been used to living in The Lodge and Kirribilli for the last few years I’m guessing that her standards have gone up (nothing against Altona…well not much). Word on the street is that Julia and the former ‘first bloke’ Tim Mathieson have snapped up a new abode in her former home town of Adelaide. A sold sticker was placed on the for sale board out the front of the Adelaide property earlier this week and it is believed that the property has been purchased through a buyer’s agent for a price around the 2 million dollar mark. Interestingly the listing by the agent has now been removed.

That being said, if Julia and Tim have purchased this new love nest then they’ll be able to enjoy a 12-person spa, a commercial pizza oven, a nine-burner barbecue and even a secret trap door that leads to a wine cellar. Let’s hope that there is an invite to their housewarming BBQ soon!

The mysteries of depreciation

One of the things that has taken me a long time to understand when it comes to investing is property depreciation and how it works with your income and particularly around tax time. I just sat through a webinar this evening (note my previous post about being willing to learn and becoming a student again) and it reminded me how challenging it was for me to get my head around it but also how beneficial it was once I knew about being able to utilise property depreciation to claim ‘non-cash’ deductions on your investment property come tax time.

In a nutshell it basically means that the cost of the property itself (both the building and the fixtures inside it) decrease in value over time, essentially it’s talking about wear and tear over the years. In Australia (I’m not sure about other countries) the tax office allows for legitimate deductions taking into account this decrease in value of the property and it’s fixtures each year. In the webinar it was stated that as much as 80% of investors are not claiming as much as they could be on these non-cash deductions each year. I certainly realised this a few years ago when I had a full depreciation schedule done on one of my properties. I was pretty pleased when the report outlined the amount that I could claim. The thing is however that you need to get a qualified quantity surveyor to prepare the report as that is all the tax office will accept. You’ll need to spend some time looking around to find the right person to do this for you. Don’t hesitate to compare and ask several surveyors about what they can do and the costs associated.

I’d certainly encourage all investors new or old to learn more about depreciation and how it can apply to your own circumstances, it can make an amazing difference to what you can claim against your investments and potentially a nice improvement on your tax return. The YouTube video below is from an Australian company (the ones that conducted the webinar) and I’d say is worth a look. This company is just one of many and I’d encourage you to look around and find one that suits your own needs.

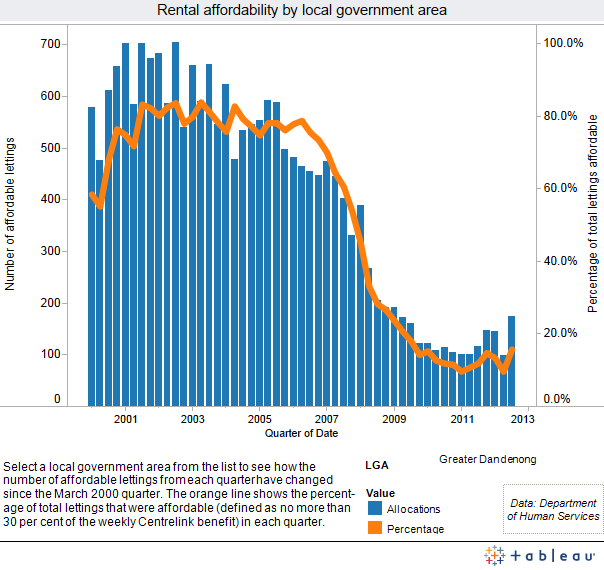

Rental affordability

An interesting article was posted today in The Age regarding information that was recently made available by the Department of Human Services in Victoria looking at rental housing affordability. The article highlights that the figures indicate that rental affordability in what have been traditionally cheaper areas has decreased, particularly over the last 5 years or so. It is interesting to see that rental affordability is stated as constituting no more than 30 per cent of a weekly welfare payment. A few comments are raised regarding the difference between affordability in metropolitan and regional areas as well as some of the perceived influences over why this affordability is decreasing. I’d recommend having a read over the article to have a look at some of the comments people are making, I can’t say I agree with them all but always interesting to hear perspectives other than your own. If you would like to see the rental affordability for other areas in Victoria click on the image below to go to the interactive table where you can select individual municipalities.